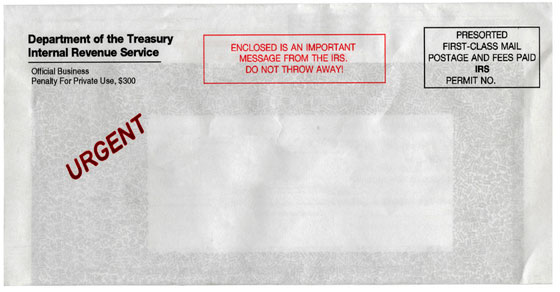

During this busy tax season, the IRS is reminding individuals how it will and, more importantly, won’t contact taxpayers. If the IRS needs to contact you, typically it first delivers a letter through the mail. The agency may call after mailing a notice to confirm an appointment or to discuss an audit. Also, in certain cases, the IRS may make unannounced visits to a taxpayer’s home or place of business to discuss taxes owed. The IRS will never send a text or try to contact you through social media to get personal information or collect taxes, demand immediate payment using a specific payment method, or threaten to have you arrested. For more details: http://bit.ly/3JtanGb